The ratification of Law No. 7566 in late 2025 has fundamentally altered the payroll and tax compliance landscape for foreign entities operating in Turkey. While standard reports focus solely on minimum wage increases, Vergi Merkezi | Mali Müşavirlik provides a specialized analysis of the 2026 fiscal year, focusing on employer burden optimization and regulatory alignment.

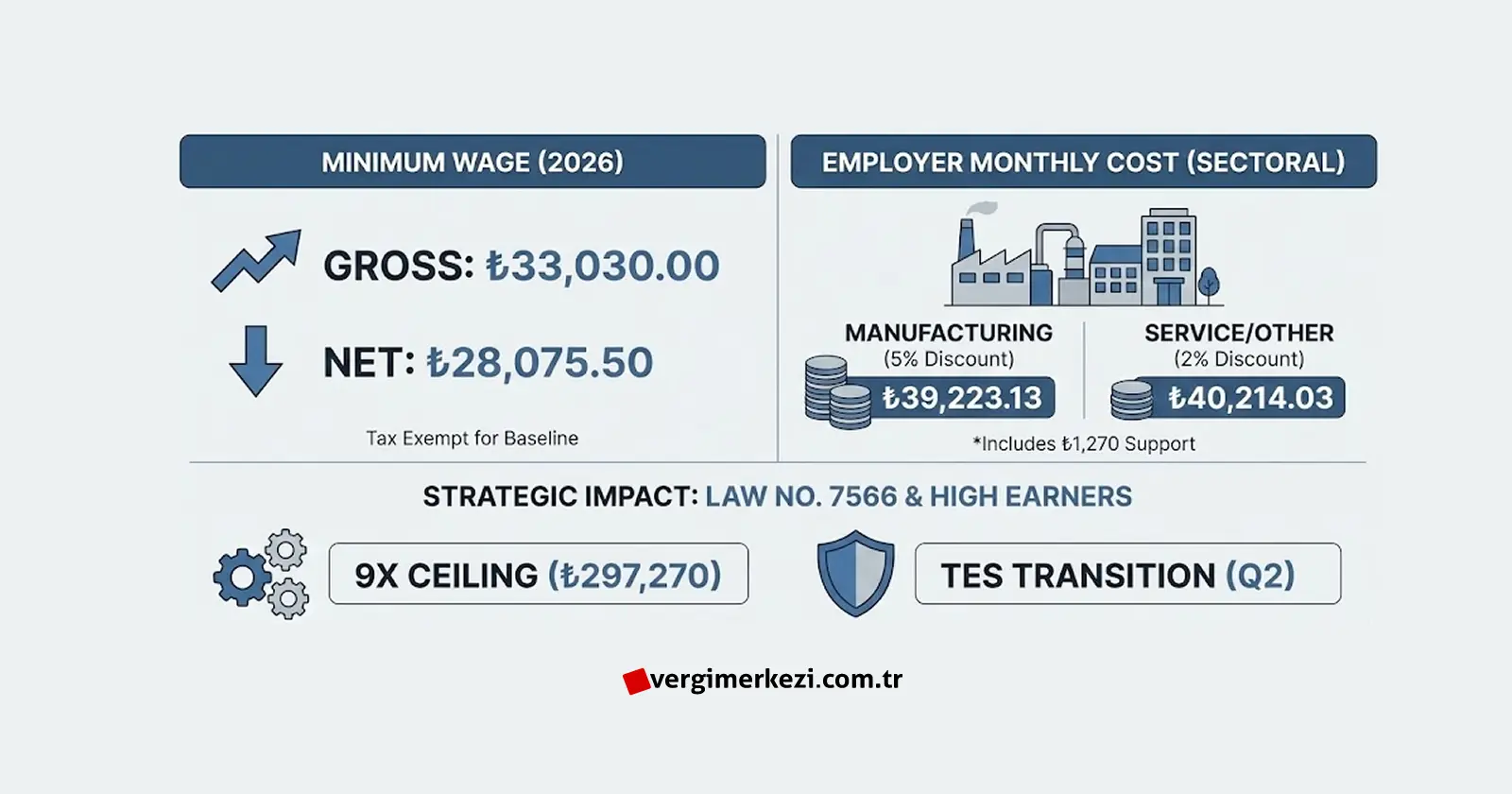

1. 2026 Minimum Wage: Beyond the Surface Numbers

The statutory minimum wage is no longer just a “baseline” but a primary driver of overall payroll inflation due to the tax-exempt status of this bracket.

| Component | 2026 Statutory Value (TRY) | Strategic Impact |

| Gross Minimum Wage | 33,030.00 | Basis for all SGK and tax ceilings. |

| Net Minimum Wage | 28,075.50 | The actual take-home pay for the employee. |

| Daily Gross Amount | 1,101.00 | Critical for part-time and daily-basis reporting. |

2. Sectoral Cost Divergence: The New Incentive Structure

Law No. 7566 introduces a critical differentiation between manufacturing and non-manufacturing sectors. Understanding your NACE code’s eligibility for the 5-point vs. 2-point discount is vital for 2026 budget accuracy.

Comparative Monthly Employer Costs

- Manufacturing Sector (5% Discount): The total monthly cost per employee is 39,223.13 TRY.

- Other Sectors (2% Discount): The total monthly cost rises to 40,214.03 TRY.

- Non-Incentive (Standard): Without regular payments or compliance, the cost peaks at 40,874.63 TRY.

Expert Note: The monthly Minimum Wage Support of 1,270.00 TRY is automatically credited against employer SGK debts, provided the company remains compliant with social security reporting deadlines.

3. High-Earner Risk: The 9x Ceiling Impact

Unlike previous years, the Social Security Ceiling (SPEK) has been adjusted to 9 times the gross minimum wage (297,270.00 TRY). For foreign companies employing senior management or technical expatriates, this means:

- Increased Tax Leakage: Salaries exceeding the previous 7.5x ceiling are now subject to additional social security premiums.

- Budget Correction: Payroll budgets for specialized staff must be adjusted by an average of 12-15% to account for this ceiling expansion.

4. Compliance Checklist for Foreign Investors

To stay ahead of the regulatory curve in 2026, foreign companies must address the following:

- Occupational Code Accuracy: Ensure employees are reported with correct job titles. Incorrect coding is a primary trigger for AI-driven SGK audits in 2026.

- TES Transition: Prepare for the transition from OKS (Automatic Enrollment) to the mandatory Supplementary Retirement System (TES) scheduled for the latter half of 2026.

- Regional Incentives: Evaluate if your operations qualify for Law No. 6486 (Regional Incentive) which can provide an additional 6% discount in specific investment zones.

5. Frequently Asked Questions (FAQ)

Is there an income tax on the 2026 minimum wage?

No, the 2026 minimum wage remains exempt from Income Tax and Stamp Tax, significantly reducing the administrative burden for baseline payroll.

How does the 1,270 TRY support affect the net cost?

The support is an employer-side deduction. For a service sector employee, it reduces the effective cost from 40,214.03 TRY to approximately 38,944.03 TRY.

Optimize Your Turkish Operations with Vergi Merkezi

As Vergi Merkezi | Mali Müşavirlik Hizmetleri Ltd. Şti., we specialize in helping international businesses navigate the complexities of Turkish tax and labor laws. From Technopark incentives to executive payroll management, our 20+ years of experience ensures your compliance is absolute.

For Online Services and Information Contact Us

Ready to establish or grow your business in Turkey? Contact Vergi Merkezi | Mali Müşavirlik today for a consultation with our expert accountants.

- 📞 Phone: +90 533 328 37 04

- 📧 Email: [email protected]

Bir yanıt yazın